The current housing market can be tough on both you, the real estate agent, and your buyers. Rising home prices and multiple bids will often discourage even the most avid buyer. That said, what is the cost of waiting out the housing market? In my conversations with my clients, I hear two main concerns:

- They worry that the rising home prices are a precursor to another housing crash like the one we saw in 2008. They don’t want to get burned and contemplate waiting to buy a home at some future date when the market cools down.

- As more and more homes seem to be going above asking price my clients express concern that they are overpaying for a property and are worried they may have to come up with a larger down payment if a home doesn’t appraise for the inflated asking price.

Addressing Buyer Concerns

These are real concerns that I am sure your buyers are expressing to you as well. However, in most situations, these concerns can be overcome by reviewing several facts with your client. First, I do not believe we are facing another housing bubble. Barry Habib, founder and CEO at MBS Highway, a provider of mortgage industry news and analytics and two time winner of the Crystal Ball Award based on his accuracy of future real estate trends, has made the following observations:

- Housing Bubble Fears are Nothing New- every year since 2014 the the media has reported on the fear of a housing bubble. Yet, the numbers do not validate this fear.

- Rising Demand for Homes- The average age of first time home buyers is 33 years old. Looking back at population/birth numbers we find that we are about ready to see an explosion of perspective new buyers in the coming years.

- Record Low Housing Completions and Inventory- While demand continues to surge for homes the construction industry, still smarting from the last housing crash of 2008, continues to provide very low numbers of new construction. Likewise, we have seen the inventory of available homes continue to shrink from a record 3.7 million in 2007 to a record low of 1.2 million today.

- Affordability- Housing today remains far more affordable than it was just back in 2006. While home values have certainly increased so have income levels. Even if rates were to increase into the mid-to-high 3’s, people would be spending less ( %) of their monthly income towards housing than they did in 2006.

Click here to see some of Barry’s additional analysis. For some of Barry’s additional thoughts.

Home Purchase Buy-Wait Decision Process

I want to share with you the process I use to help my clients understand the cost of waiting to purchase a home and help them assess whether or not they should be willing to pay over asking price. In other words, this is our Home Purchase Buy-Wait Decision process and it definitely shows that now is the time to buy a new home.

Now Is The Time To Buy

At Revival Lending we walk through all this information with our clients. We want them to be fully informed that now is the time to enter the housing market. This isn’t just wishful thinking but backed up by facts. In fact, the cost of waiting may be more than they can really afford.

Cost of Waiting Analysis

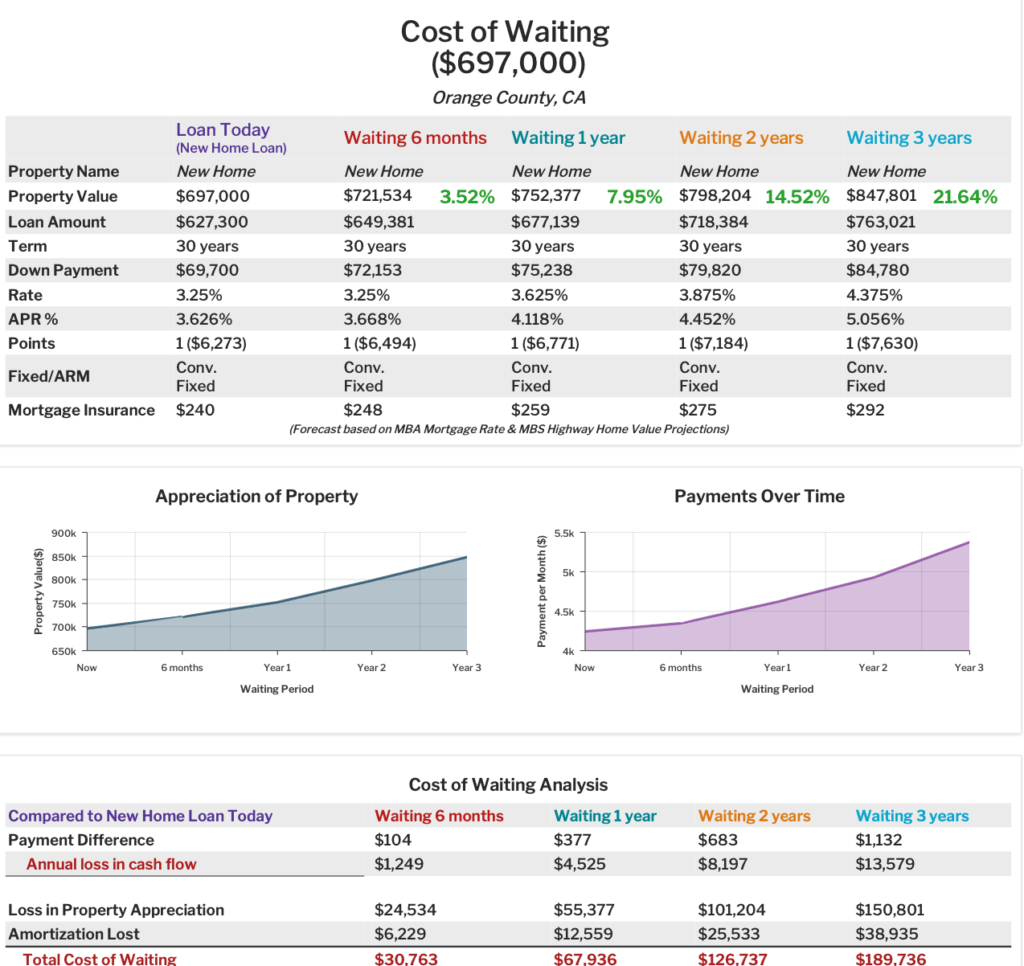

Anytime a client talks about waiting out the current market, I provide them with a Cost of Waiting Analysis. This shows them, based on their expected purchase, what the cost of waiting would be by waiting just 6 months, 1 year, 2 years and even 3 years based on the local market.

For example, the above graphic reveals a buyer looking at purchasing at $697,000 home could cost themselves over $30,000 by choosing to wait for 6 months and and anticipated $190,000 by waiting three years. Just imagine the gratitude a buyer will feel in three years when they realize their net worth has increased nearly $200,000. We can you show your clients the need for them to take action today and not to put off their purchase. It is a competitive market and you need partners that provide true data to your clients. As you can see, we take our role as mortgage advisors very seriously. Give us a call and let us help you and your buyers!

Revival Lending – Certified Mortgage Advisors

At Revival Lending, we are Certified Mortgage Advisors. We will work to design a customized loan to facilitate your goals. We want to earn your business over a lifetime and not just through a one-time transaction. Therefore, we promise to take the time to truly understand your goals and help you map out a plan to use your mortgage and home to reach them. Set up an appointment with us today. I promise you will not be disappointed. Call 714-257-5284 or email us to schedule a complimentary mortgage review today.

comments +